FOR CONTEXT

Ledgerfolio is a web application in the debt administration space that specialises in corporate loan settlement. It blends the expertise needed to handle complex loan transactions as a loan agent with new technology to service the the trading and settlement of these loans in the secondary market. It offers all the functions of a traditional loan agent with the added kicker of an online platform to allow clients to close their trades quicker. By allowing users to take control of the process, it saves them time, cost and unnecessary administration.

PROBLEM

The loan market currently doesn’t have an end to end system that takes trades from execution to settlement. Most trade settlements are done by pen and paper and quite literally have to be sent it by borrowers as a word or excel document and then entered manually into the system by loan agents. In an increasingly automated world, this is a huge gap in the system and is not in keeping with the times or with user needs.

SOLUTION

Building a web application that provides all the traditional agency functions required in loan transactions but with a settlement platform that allows straight through processing (STP) of trades. A platform that covers all aspects of trades from pre-trade matching to trade execution and confirmation all the way through to settlement. With everything on one platform, it will allow users to close loan trades quickly with minimal effort.

ROLE

Product Designer

KEYWORDS

Web Application

CATEGORY

B2B, B2C

DESIGN TOOLS

Figma, Sketch

YEAR

2019

Ledgerfolio’s Best Use Case Explained

A loan agent administers assets and debt facilities for borrowers. Loan agents often safeguard assets on behalf of lenders, process trades and maintain a ledger of ownership - like a share register. As a bridge between lenders and borrowers, Ledgerfolio is set up as an independent loan agent. In a loan transaction, Ledgerfolio sits between borrowers and lenders.

Ledgerfolio is developed to be adapted for syndicated loans and private debt. A proprietary product that offers clients a full suite of digital services for Primary syndication, loan closing and Facility/Security Agency. Bringing this product to market involved making sure that certain steps were put in place to provide the same trust factor users were used to while carrying out this process as they always have. Digitizing a process does not mean abandoning all aspects of the process that gave users confidence while carrying out actions in this space.

Narrowing the Problem Through Research

The stakeholders having a lot of loan market experience, perceived the loan market as a house with broken plumbing. They sort to address the pain points of corporations, banks and institutional lenders. The loan market institution is one that requires transparency, liquidity and fast settlement, the current market of which takes 40 days to settle a loan. Ledgerfolio’s aim was to reduce this period significantly. By filling this gap, Ledgerfolio aimed to make the market more transparent and more liquid. By enabling a more liquid observable market, the product would expand the number of investors who can buy loans. The benefits are endless - to corporate borrowers who will benefit from cheapests rates and to lenders who will have a more liquid, clearable product.

The stakeholders having such an extensive background in the loan market industry greatly helped in our search for our survey and interview participants. In fact, there was already such a perceive gap for a need of this sort of product, that many articles and past prints from many journals and reports provided us with a good background for questions and insights to look for during our research.

“A faster settlement window would reduce the difference between loans and bonds. Investors might be attracted to loans that are senior to bonds, but are currently put off by how long loan trades take to settle.”

Source: 2019 European Commission’s report - ‘EU loan syndication and its impact on competition in credit markets.

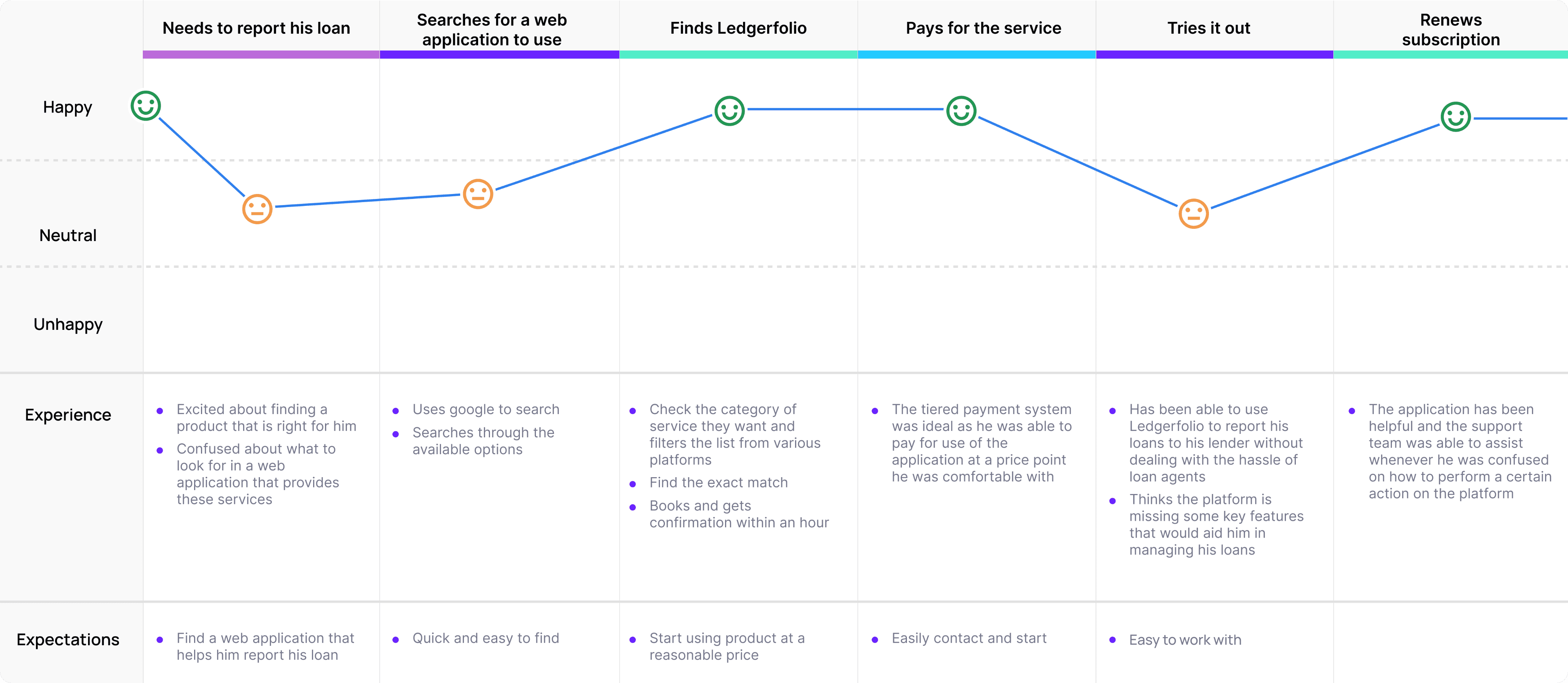

Synthesizing User Feedback

Creating a product that some would view as new in the market will always bring us the issue of uncertainty and generating trust in our product. So understanding a user’s wants and needs was crucial in building this product as it not only provided the blueprint for what features we would develop but also provided the business with financial research as to what users would feel comfortable paying for.

Knowing this, understanding the user journey would not only help us understand what the user goal would be but also what features and navigational elements would help the user in reaching their goal.

The Challenge of Reinventing the Wheel

The insights gained from our research helped us truly understand what users would be expecting from a platform like this and what features would help them reach their goal and also build trust in our product.

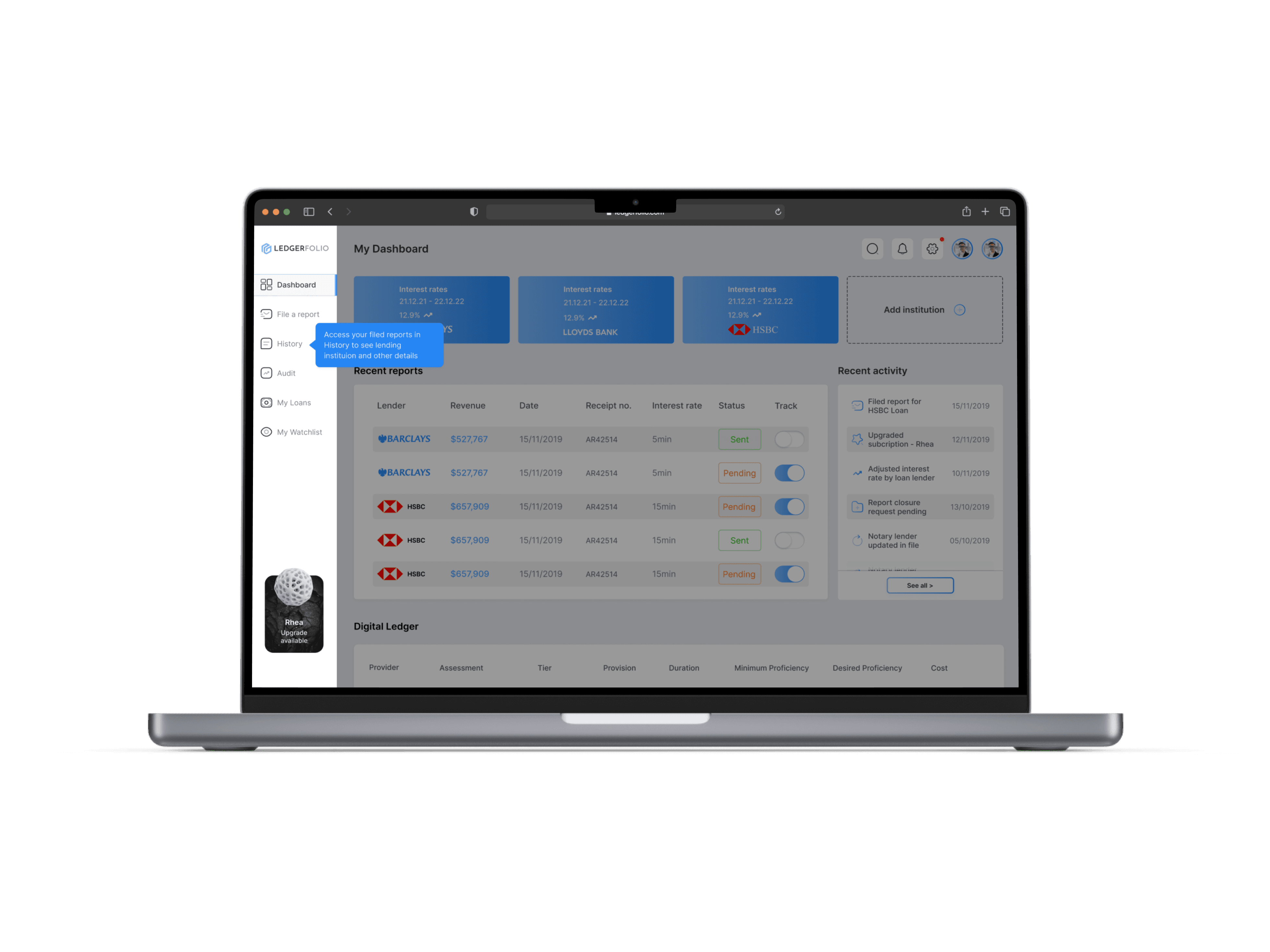

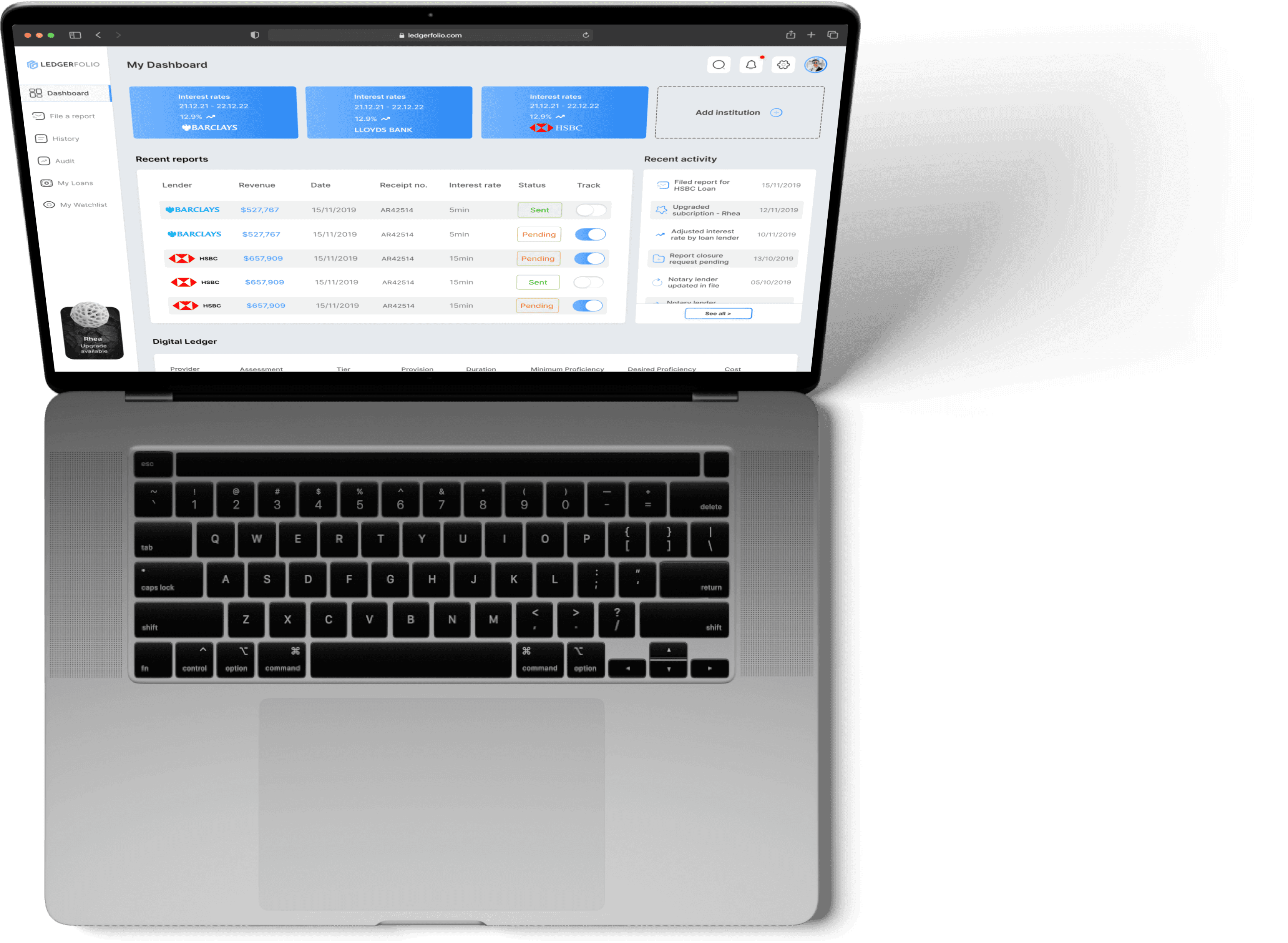

Being a new product without many other competitors in the market, a problem we found during user testing of our prototype was the user’s frustration with navigation. We found that users were often bewildered with how to complete their goal and so we carried out a card sorting exercise to better categorise navigational elements. We also implemented the use of tooltips to aid users in navigation and carrying out certain functions. A tool tips toggle was added to aid veteran users of the application who no longer needed help finding their way around the product, turn it off so as not to feel frustrated by what they might deem persistently unhelpful information.

Business Requirements Vs. User Needs

Working as a product designer on this project, I had to take not only the users needs into consideration but also the business needs. From conversations with our users, we found that not everyone found need for all the features we were providing. We needed to provide the service at a cost where users would feel properly catered to by the product but also for it to be profitable for stakeholders. In lieu of this, we set up a tiered system where different features of the application would be available at different price points which would be indicated by tiers. A user could enter the service at a tier they’d be comfortable with, without having to pay a premium for features they would deem unnecessary otherwise.Synthesizing the data from our user research provided us with a base system and an understanding for which features would fall into what tiers and what users considered a base offering at entry level for the service.

Tethys

Upgrade available

Tier 1

Pre-trade KYC Checks

Confirm and settle trades

Digital ledger

Cloud documentation storage

Verified transaction audit trail

Rhea

Upgrade available

Tier 2

Pre-trade KYC Checks

Confirm, allocate and settle trades

Automated/Scheduled reports

Actively manage lender lists and corporate actions

Digital ledger

Cloud based documentation storage

Verified transaction audit trail

Titan

Premium membership

Tier 3

Pre-trade KYC Checks

Confirm, allocate and settle trades

Automated/Scheduled reports

Automated legal trade documentation

Actively manage lender lists and corporate actions

Digital ledger

Cloud based documentation storage

Assigned experienced trade agent

Verified transaction audit trail

We had initially planned on a 3 star system to indicate tiers but during user testing, we found that users often felt like they weren’t being treated as importantly when not having all three stars on their profile and thought that it also served as a constantly forced reminder that they weren’t subscribed to the maximum tier.

Iterate, Iterate, Iterate.

The most crucial part of our design process was understanding what users viewed as important and immediate information that would be understood at a glance without having to click any navigational elements to get this information on the platform. Our user testing gave us differing results that ended in the implementation of a fully customisable dashboard. Users could either set up their dashboard with information they deemed important in their loan settlement process or they could keep using the application and let the algorithm determine what information would be displayed on their dashboard depending on their recent history and actions.

Building Trust

The most intriguing part of our dashboard design was understanding what users viewed as important and immediate information that would be understood at a glance without having to click any navigational elements to get thisinformation on the application. Our user testing gave us differing results that ended in the implementation of a fully customisable dashboard. Users could either set up their dashboard with information they deemed important in their loan settlement process or they could keep using the application and let the algorithm determine what information would be displayed on their dashboard depending on their recent history and actions.

Reflection

Having to take a course on Udemy on Loan management and doing loads of research on how the debt administration system works really taught me the importance of having in-depth knowledge not just about the platform you’re creating but also the business model behind it. In a bid to become a better designer, one must always seek to acquire new knowledge.